Overview

The SI.WRITEBACKJOURNAL function defines a single journal transaction line to be uploaded to Sage Intacct.

For a short overview of the Journal Writeback process see: Journal Writeback (Sage Intacct).

Performing writeback (i.e., Creating entities through the Sage Intacct application programming interface) requires the access rights associated with a Full User.

Employee-type users in Sage Intacct would not be able to successfully perform a writeback.

The SI.WRITEBACKJOURNAL function is used to *create* journal transactions. It cannot be used to modify/update existing transactions.

In order to separate multiple Writeback functions into groups and execute them in batches, you can use the WRITEBACKCOMMIT function.

Syntax

=SI.WRITEBACKJOURNAL(

ConnectionName,

Journal,

PostingDate,

ReverseDate,

JournalDescription,

ReferenceNumber,

ShouldPost,

AdditionalBatchSettings,

Account,

Debit,

Credit,

LineCurrencySettings,

Memo,

Location,

LineAllocationSettings,

Dimensions,

UserDefinedDimensions,

Billable,

TaxEntry,

BatchNumberOutput,

ShouldOpenAfterUpload

)

Arguments

The SI. WRITEBACKJOURNAL function uses the following Header and Line arguments:

Header Info

|

Argument |

Required/Optional |

Description |

|

|

Required |

The name of the connection as configured in the Connection Manager |

|

|

Required |

GL journal symbol. This determines the type of journal entry as visible in the UI, for example, Regular, Adjustment, User-defined, Statistical, GAAP, Tax, and so forth |

|

|

Required |

The transaction date in format mm/dd/yyy |

|

|

Optional |

Reverse date in format mm/dd/yyyy. Must be greater than PostingDate |

|

|

Required |

Journal description for the transaction |

|

|

Optional |

Reference number of the transaction |

|

|

Required |

|

|

|

Optional |

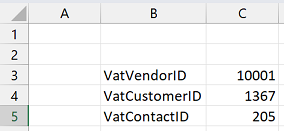

A two-column array of key and value pairs for defining the settings The

Example:

(this example sets values for |

Line Info

|

|

Required |

The GL account number for the transaction |

|

|

Optional (must be left blank if Credit amount is specified) |

The Debit amount to be sent to the GL Account |

|

|

Optional (must be left blank if Debit amount is specified) |

The Credit amount to be sent to the GL Account |

|

|

Optional |

The currency code to be used for the transaction |

|

|

Optional |

A memo to be included in the transaction |

|

|

Optional (Required if muti-entity is enabled) |

ID code for the Sage Intacct location to be used for the transaction

|

|

|

Optional |

Allocation ID The

|

|

|

Optional |

A two-column (or two-row) Excel range, where the first column/row contains the name of a predefined analytical dimension (e.g. department, customer, project etc.), and the second column/row contains the semicolon-separated list of values or that dimension. For user-defined dimensions, use the |

|

|

Optional |

A two-column (or two-row) Excel range, where the first column/row contains the name of a user-defined analytical dimension, and the second column/row contains the respective value (or a semicolon-separated list of values) for that dimension. For predefined analytical dimensions like customer, project etc., use the |

|

|

Optional |

|

|

|

Required for AU, GB, ZA only |

A two-column Excel range, where the first column contains text specifying the tax rate (as specified via the unique ID of a tax detail) and the second column contains a currency value denoting the value of the tax. |

|

|

Optional |

The Excel cell to receive the batch code number of the batch that is created |

|

|

Optional |

Indicates whether or not to open the created batch in Sage Intacct after creation |

Examples

Example 1

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Liability Insurance Accrual for December 2019",

,

FALSE,

,

"60330",

,

"1322.41",

"USD",

,

"100",

,

,

,

,

,

I9,

TRUE

)

Expanded:

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Liability Insurance Accrual for December 2019",

,

FALSE,

,

"60330",

,

"1322.41",

"USD",

,

"100",

,

,

,

,

,

I9,

TRUE

)

Description

Creates a transaction in the "GJ" journal. The transaction:

-

will be dated "12/31/2019"

-

does not have a reversal date

-

has the description of "Liability Insurance Accrual for December 2019"

-

should not be automatically posted

-

will be created for GL account #60330

-

will have the credit amount of 1,322.41 US dollars

-

will be created in location 100

In addition:

-

the number for the created batch number will be recorded in cell I9

-

Sage Intacct will automatically be opened to the batch immediately after it is created

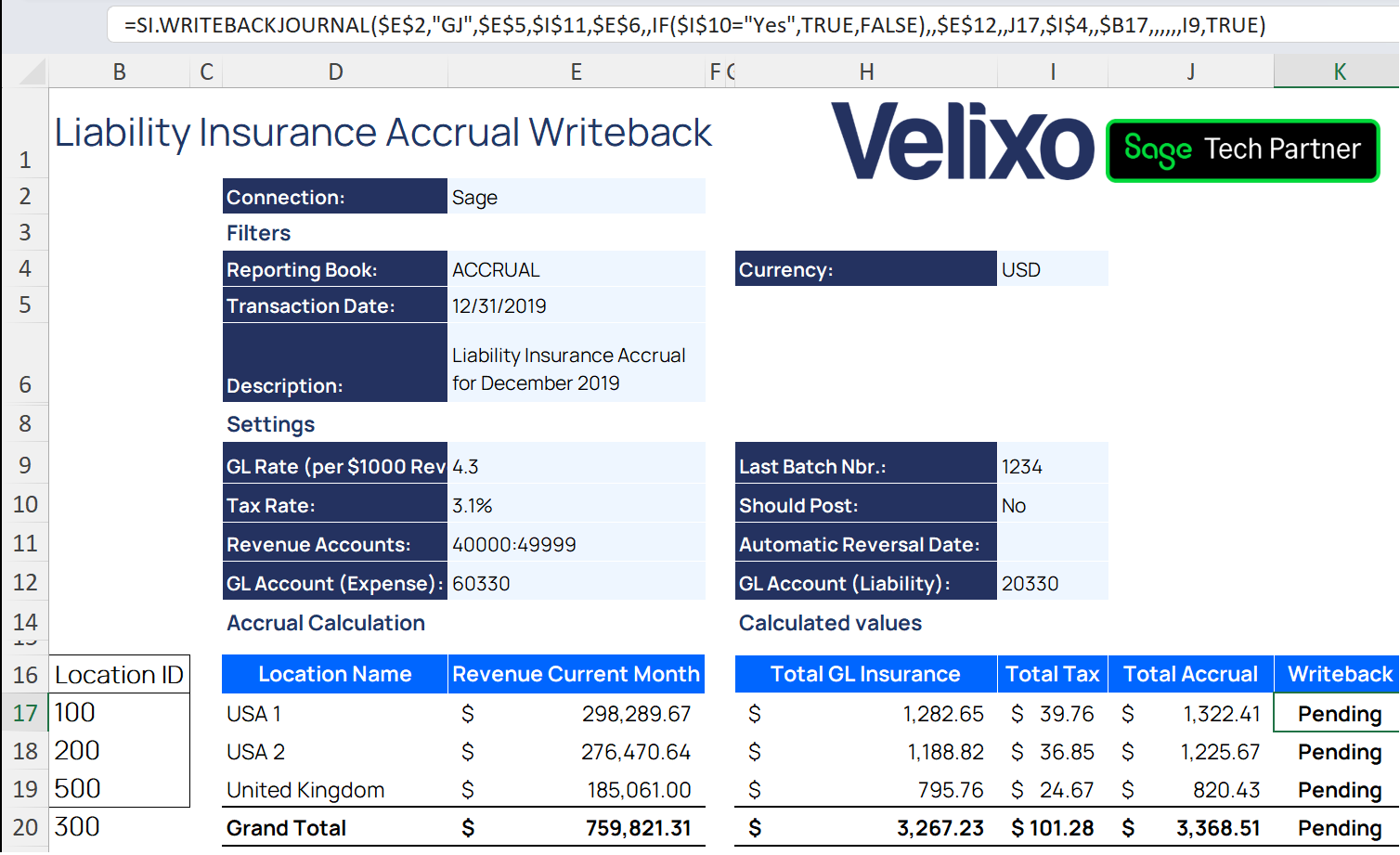

using cell references:

=SI.WRITEBACKJOURNAL(

$E$2,

"GJ",

$E$5,

$I$11,

$E$6,

,

IF($I$10="Yes", TRUE, FALSE),

,

$E$12,

,

J17,

$I$4,

,

$B17,

,

,

,

,

,

I9,

TRUE

)

Here you can see an example where the cells contain the data for the function in cell K16:

Example 2

Using the TaxEntry and AdditionalBatchSettings arguments:

For Credit transactions:

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Liability Insurance Accrual for November 2019",

,

FALSE,

{

"TaxImplications", "Outbound";

"TaxSolutionID", "United Kingdom - VAT";

"VatCustomerID", "10052"

},

"60330",

,

467.75,

"USD",

,

"500",

,

,

,

,

,

I9,

TRUE

)

Expanded:

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Liability Insurance Accrual for November 2019",

,

FALSE,

{

"TaxImplications", "Outbound";

"TaxSolutionID", "United Kingdom - VAT";

"VatCustomerID", "10052"

},

"60330",

,

467.75,

"USD",

,

"500",

,

,

,

,

,

I9,

TRUE

)

For Debit transactions:

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Liability Insurance Accrual for November 2019",

,

FALSE,

{

"TaxImplications", "Outbound";

"TaxSolutionID", "United Kingdom - VAT";

"VatCustomerID", "10052"

},

"20330",

1403.25,

,

"USD",

,

"500",

,

,

,

,

{"UK Sale Goods Reduced Rate", "89.2"},

I9,

TRUE

)

Expanded:

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Liability Insurance Accrual for November 2019",

,

FALSE,

{

"TaxImplications", "Outbound";

"TaxSolutionID", "United Kingdom - VAT";

"VatCustomerID", "10052"

},

"20330",

1,

403.25,

,

"USD",

,

"500",

,

,

,

,

{"UK Sale Goods Reduced Rate", "89.2"},

I9,

TRUE

)

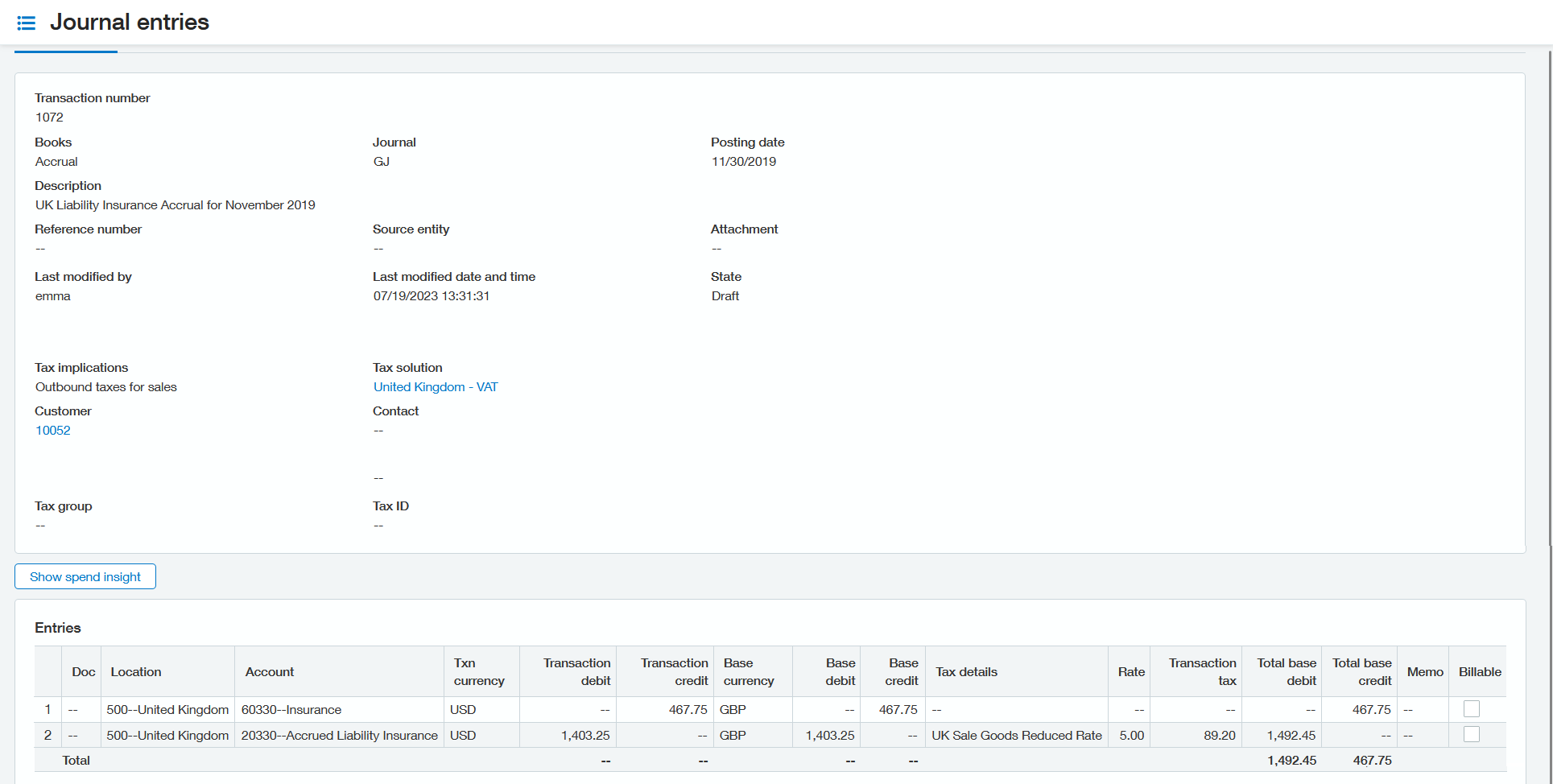

Description

Creates a transaction in the "GJ" journal. The transaction:

-

will be dated "12/31/2019"

-

does not have a reversal date

-

has the description of "Liability Insurance Accrual for December 2019"

-

should not be automatically posted

-

with Tax implications = Outbound taxes for sales, Customer = 10052, Tax solution = United Kingdom - VAT.

-

60330 GL account will be credited with the amount of 467.75 USD

-

20330 GL account will be debited with the amount of 1,403.25 USD, including tax entry with "UK Sale Goods Reduced Rate" description and 89.20 USD amount

-

will be created in location 500

In addition:

-

The number for the created batch number will be recorded in cell I9

-

Sage Intacct will automatically be opened to the batch immediately after it is created

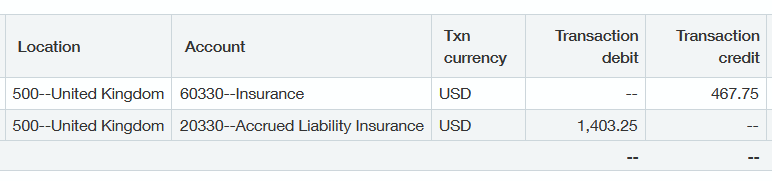

Here is the created journal entry in Sage Intacct:

In Excel, the transaction number from the journal entry has been recorded in cell I9 and the line status has been updated to Line uploaded.

Example 3

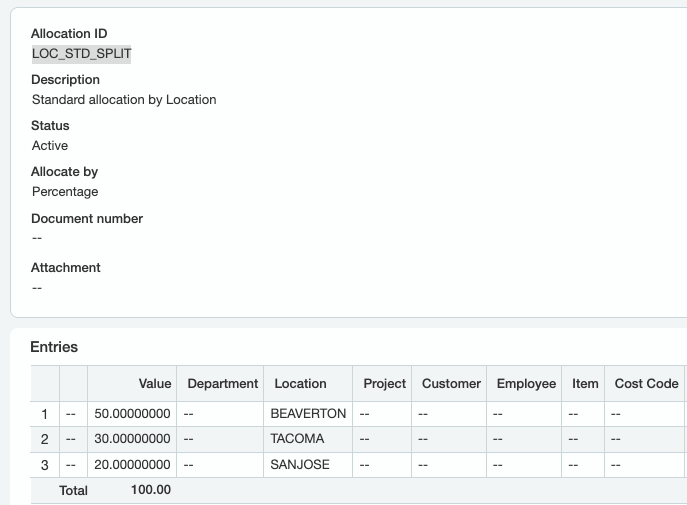

Using the LineAllocationSettings argument to provide an Allocation ID.

For Debit transactions:

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"06/06/2025",

,

"Sample transaction 3",

,

FALSE,

,

"10000",

2000,

,

"USD",

,

,

LOC_STD_SPLIT,

,

,

,

,

,

TRUE

)

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Sample transaction 3",

,

FALSE,

,

"10000",

1000,

,

"USD",

,

,

LOC_STD_SPLIT,

,

,

,

,

H9,

TRUE

)

For Credit transactions:

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"06/06/2025",

,

"Sample transaction 3",

,

FALSE,

,

"10000",

,

1200,

"USD",

,

,

LOC_STD_SPLIT,

,

,

,

,

,

TRUE

)

=SI.WRITEBACKJOURNAL(

"Sage",

"GJ",

"12/31/2019",

,

"Sample transaction 3",

,

FALSE,

,

"10000",

,

2000,

"USD",

,

,

LOC_STD_SPLIT,

,

,

,

,

H9,

TRUE

)

Description

Creates a transaction in the "GJ" journal. The transaction:

-

will be dated "06/06/2025"

-

does not have a reversal date

-

has the description of "Sample transaction 3"

-

should not be automatically posted

-

without tax implications.

-

10000 GL account will be credited with the amount of 1000 USD

-

10000 GL account will be debited with the amount of 1200 USD

-

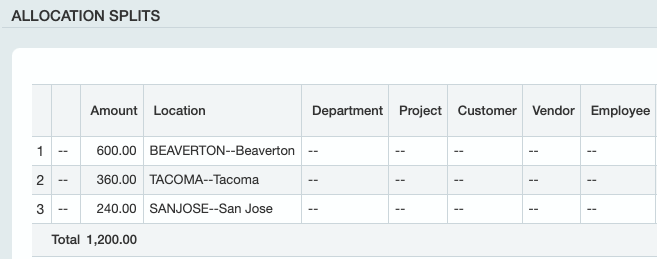

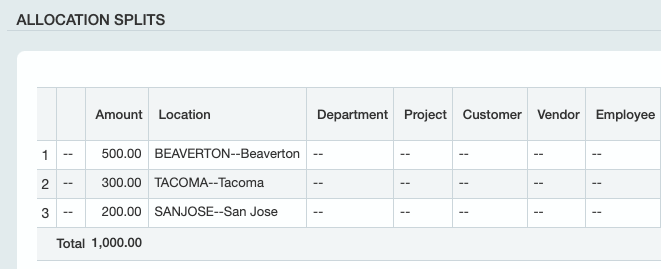

will be created according to Allocation ID LOC_STD_SPLIT, which splits the value of transactions by percentage to three locations:

In addition:

-

The number for the created batch number will be recorded in cell H9

-

Sage Intacct will automatically be opened to the batch immediately after it is created

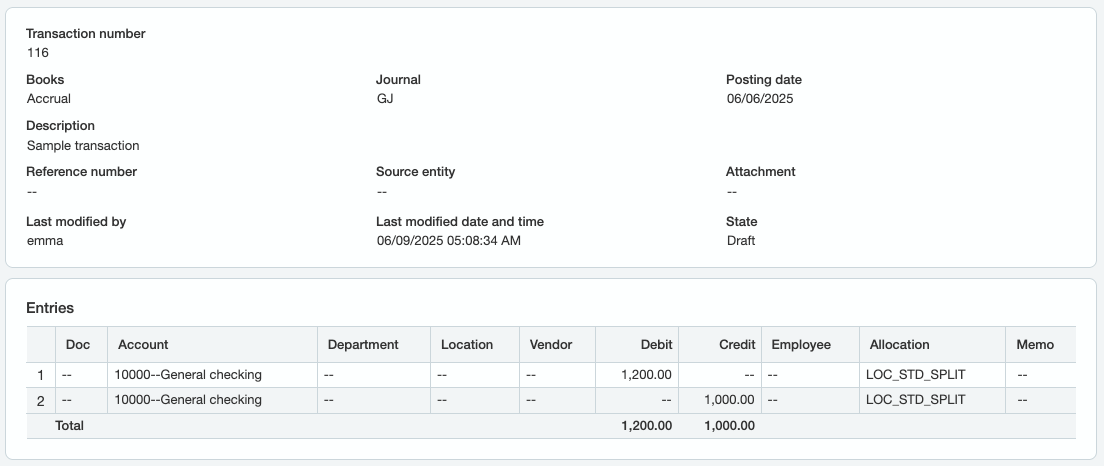

The formulas above result in the following entry in Sage Intacct:

Where the amounts are split according to the selected Allocation: