WRITEBACKJOURNAL

Overview

If you want to write a GL batch to your ERP, you can use the WRITEBACKJOURNAL function. You need to write a separate writeback function for each journal entry in the GL batch. When you select the scope of the Perform Writeback action on the ribbon, all writeback functions in this scope (Current Sheet or Selected Cells) will be grouped in GL batches and written to the ERP.

Syntax

=WRITEBACKJOURNAL(

ConnectionName,

TransactionDate,

PostPeriod,

Description,

Branch,

Ledger,

Currency,

AutoReversing,

LastBatchNbr,

OpenAfterWriteback,

AutomaticallyRelease,

CreateTaxTransactions,

SkipTaxAmountValidation,

Account,

Subaccount,

Project,

ProjectTask,

CostCode,

Quantity,

ReferenceNumber,

UoM,

Debit,

Credit,

TaxID,

TaxCategory,

TransactionDescription,

NonBillable,

CustomFields,

LineBranch

)Arguments

The arguments of the WRITEBACKJOURNAL function can be divided into two groups:

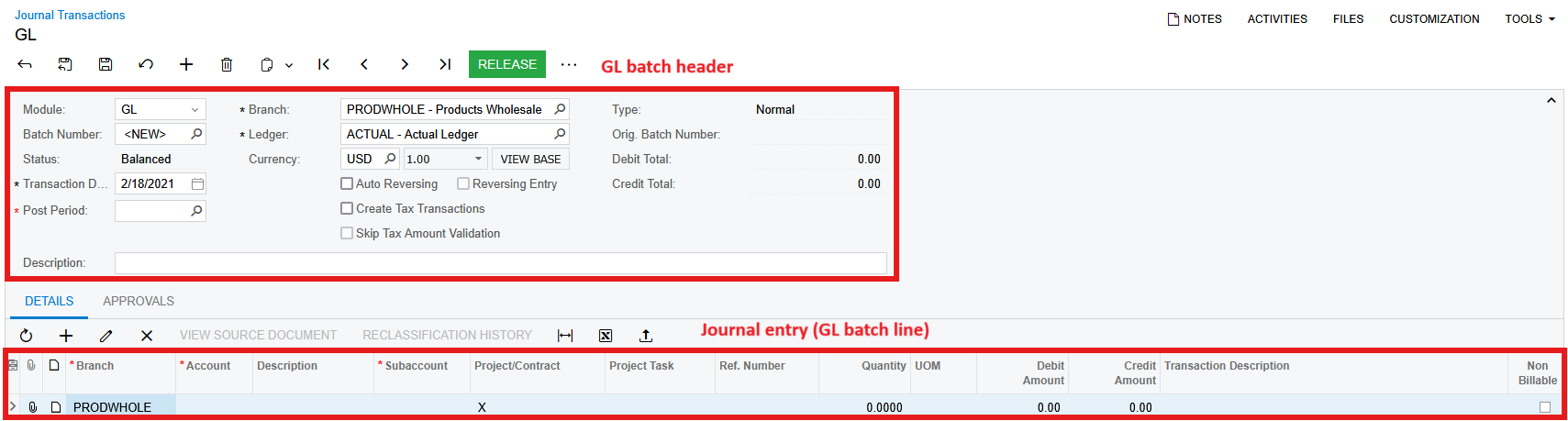

The arguments of the GL batch header

The arguments of the journal entry (GL batch line).

The arguments of the GL batch header should be the same for all journal entries you will add to the batch.

Argument | Required/Optional | Description |

|---|---|---|

| Required | The name of the connection, as specified in the Connection Manager |

| Required | The date when the GL batch was created. |

| Required | The financial period to which the journal entries should be posted. All journal entries from a GL batch are posted to the same financial period. |

| Required | A description of the GL batch. |

| Required | The branch to which this GL batch is related. It may differ from the branches in the journal entries. |

| Required | The identifier of the ledger to which the journal entries are posted. |

| Required | The currency used for all the journal entries in the selected GL batch. |

| Required | If selected, the general ledger automatically creates a batch that reverses the original debit and credit transactions in the next financial period. A reversed batch will be created when the original batch is released or posted, depending on the Generate Reversing Entries option selected on the General Ledger Preferences (GL102000) form. |

| Required | The sequential batch number. If the batch with the |

| Required | When the entire batch is processed, open it in Acumatica. |

| Required | Automatically release the new GL batch. |

| Required | If |

| Required | If |

The arguments of the journal entries

Argument | Required/Optional | Description |

|---|---|---|

| Required | The account whose balance is updated by the journal entry. |

| Required | The subaccount used with the account to detail the journal entry. |

| Optional | The project or contract with which this journal entry is associated. |

| Optional | The particular task of the project with which this batch is associated. |

| Optional | The cost code with which this batch is associated to track project costs and revenue. |

| Optional | The quantity of items associated with the transaction, if relevant. |

| Optional | The reference number of the external or internal document associated with the journal transaction. The documents’ reference numbers must be specified for tax-related transactions. These numbers are required because tax and taxable amounts are reflected in the tax reports only if the transactions are linked to the corresponding documents. |

| Optional | The unit of measure for items associated with the transaction, if relevant. |

| Optional | The debit amount of the journal entry. You should specify either |

| Optional | The credit amount of the journal entry. You should specify either |

| Optional | The tax used to calculate the tax amount. It can be specified only if |

| Optional | The tax category based on which the taxable amount is calculated. It can be specified only if |

| Optional | A description of the transaction or any comments relevant to the transaction. |

| Optional | If |

| Optional | The two-dimensional array of custom field names and their values. See examples and detailed explanation below. |

| Optional | The branch associated with the specific line. If not specified, the batch |

Output

The function returns its status, which can be one of the following:

Pending - the formula is pending to be processed.

Line Uploaded - the formula was processed successfully.

Error - an error occurred during the processing of the formula.

Custom fields

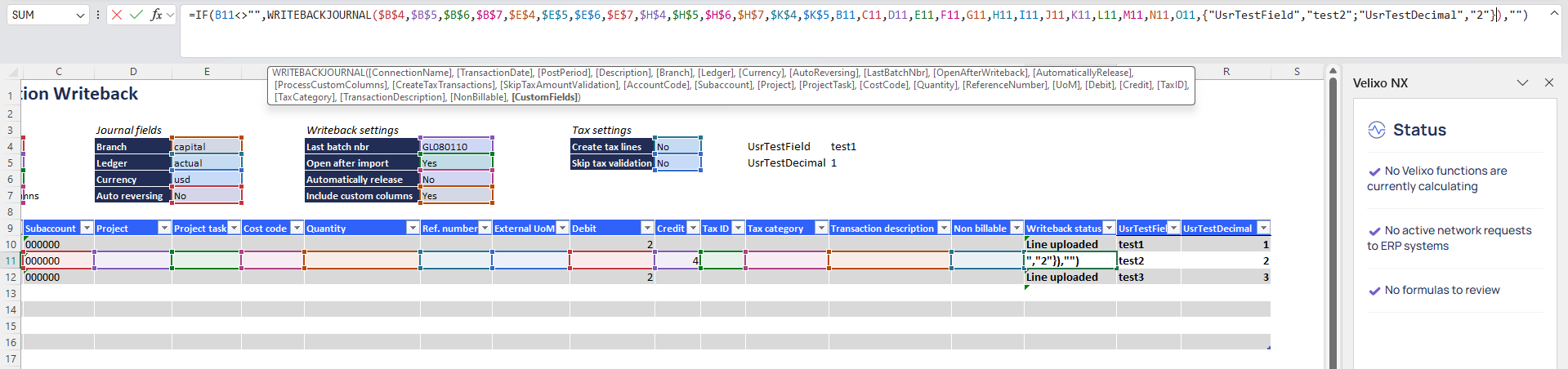

If you want to fill the custom fields with static values, you can use inline array definition ({"Column1","Value1";"Column2","Value2"})

This approach is straightforward but does not allow using references to cells.

If you need to reference a single cell (for instance, want to write a GL batch-scoped field), the easiest way could be the following: HSTACK("BatchScopedCustomField", $G$4)

If you want to write several journal entry-scoped custom fields, you need to specify their names in the first column of the array and the values in the second column.

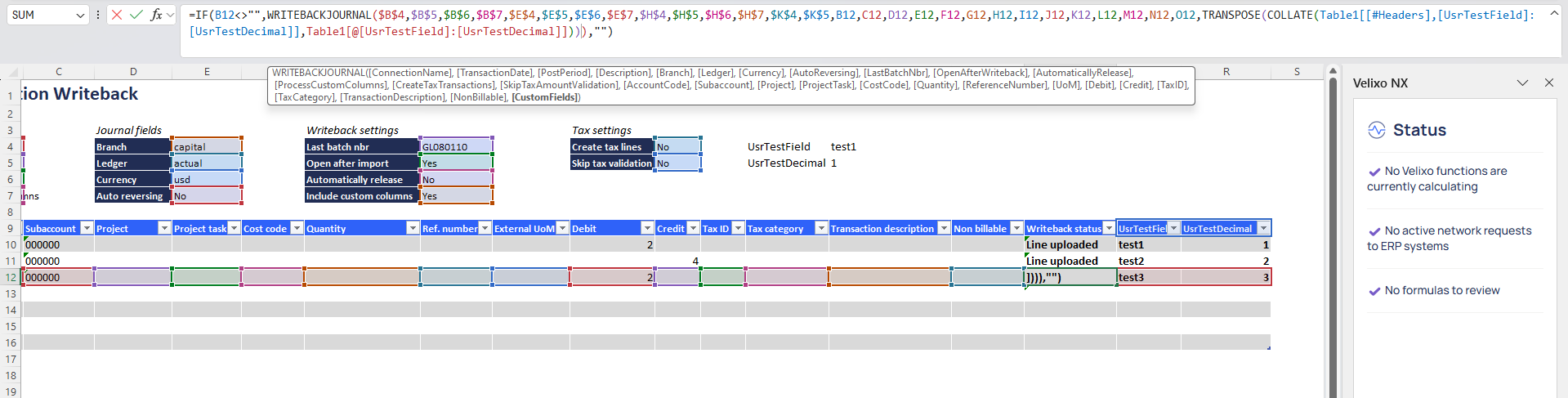

You can do it by transposing the Excel arrays: TRANSPOSE(COLLATE(Q9:R9,Q12:R12))

Eventually, If you want to mix batch-scoped and journal entry-scoped custom fields HSTACK(VSTACK($M$4,$M$5,$Q$9,$R$9), VSTACK($N$4,$N$5,Q10,R10)) where the first two arguments of the first VSTACK function contain GL batch-scoped custom field names, and the rest are journal entry-scoped custom field names. The arguments of the second VSTACK function contain corresponding values.

Example

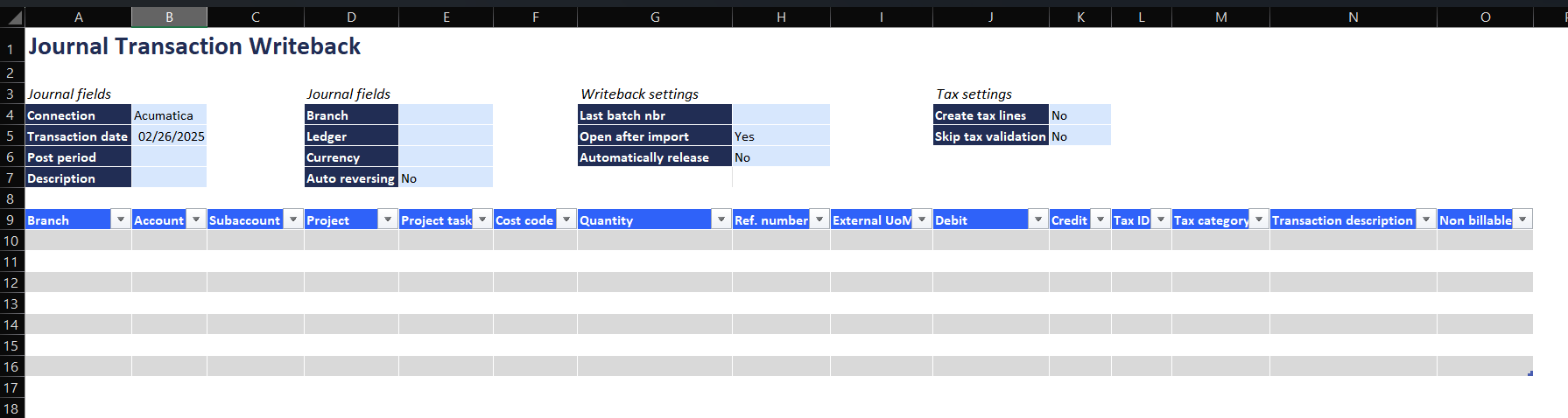

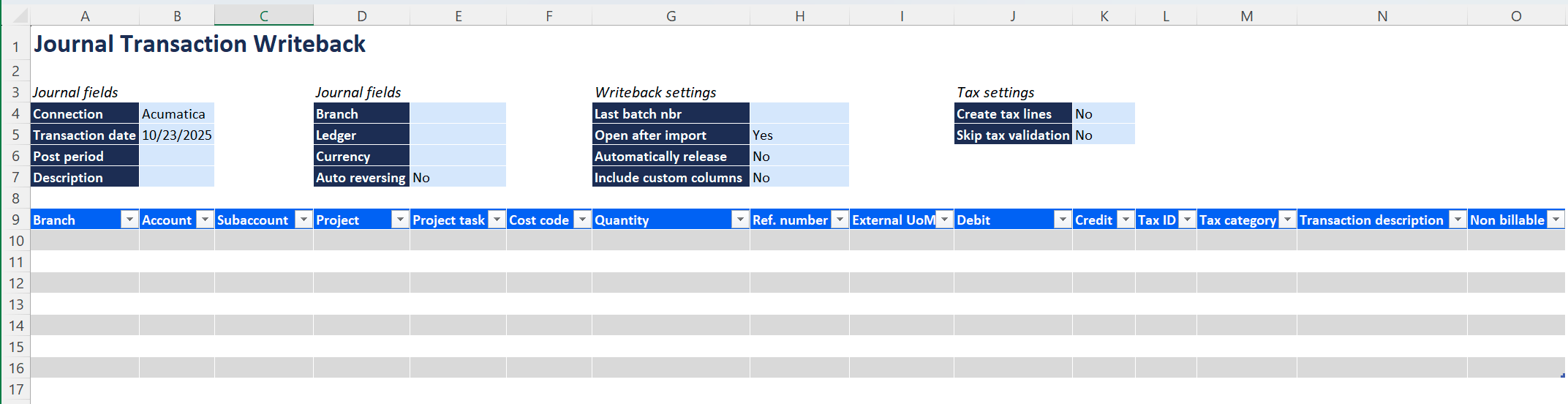

If you have prepared the following workbook to write GL batches to your ERP

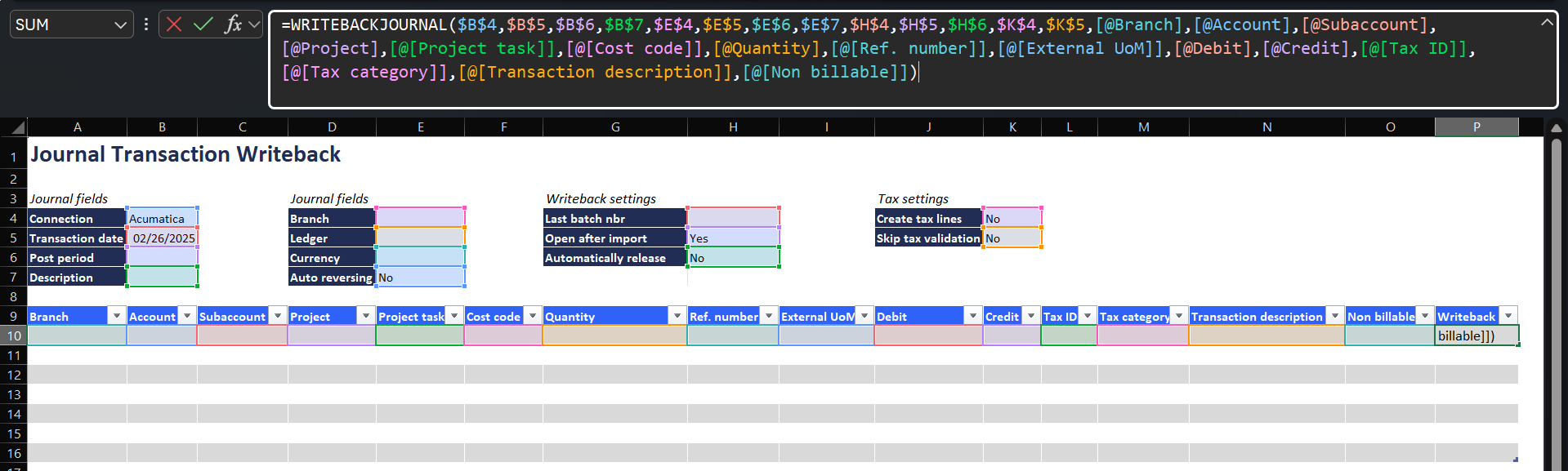

Then, you need to add a column to your table and fill it with the following function:

=WRITEBACKJOURNAL(

$B$4,

$B$5,

$B$6,

$B$7,

$E$4,

$E$5,

$E$6,

$E$7,

$H$4,

$H$5,

$H$6,

$K$4,

$K$5,

[@Branch],

[@Account],

[@Subaccount],

[@Project],

[@[Project task]],

[@[Cost code]],

[@Quantity],

[@[Ref. number]],

[@[External UoM]],

[@Debit],

[@Credit],

[@[Tax ID]],

[@[Tax category]],

[@[Transaction description]],

[@[Non billable]]

)You may notice that the Excel table columns are referred to by their names.

The result should look as follows:

Now you can fill in your data and Perform Writeback to see it in the ERP.